papalab.ru

Prices

Is Apple A Strong Buy

Apple stock has a very good return on profit from what I've read, but it's also overvalued. So whatever investment plan you make, it's also a. Summarizing what the indicators are suggesting. Neutral. SellBuy. Strong sellStrong buy. Is Apple stock a Buy, Sell or Hold? Apple stock has received a consensus rating of buy. The average rating score is Aaa and is based on 70 buy ratings, As of January , Apple has a market capitalization of $ trillion, making it one of the highest-valued companies in the world. Strong Sell. About Apple Inc. Sector. Information Technology. Industry. Technology Hardware, Storage & Peripherals How do I buy Apple (AAPL) stock? A. You can. Apple stock is back at record levels, but then AAPL has been a buy-and-hold winner for the ages. It's always a good time to buy Apple, just keep a long term perspective and ignore the news. You'll be very happy in 20 years. Apple Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Upside) ; Blogger Sentiment. Bullish. AAPL Sentiment 73% Sector. Is Apple Stock a good buy in , according to Wall Street analysts? The consensus among 27 Wall Street analysts covering (NASDAQ: AAPL). Apple stock has a very good return on profit from what I've read, but it's also overvalued. So whatever investment plan you make, it's also a. Summarizing what the indicators are suggesting. Neutral. SellBuy. Strong sellStrong buy. Is Apple stock a Buy, Sell or Hold? Apple stock has received a consensus rating of buy. The average rating score is Aaa and is based on 70 buy ratings, As of January , Apple has a market capitalization of $ trillion, making it one of the highest-valued companies in the world. Strong Sell. About Apple Inc. Sector. Information Technology. Industry. Technology Hardware, Storage & Peripherals How do I buy Apple (AAPL) stock? A. You can. Apple stock is back at record levels, but then AAPL has been a buy-and-hold winner for the ages. It's always a good time to buy Apple, just keep a long term perspective and ignore the news. You'll be very happy in 20 years. Apple Stock Smart Score ; Analyst Consensus. Moderate Buy. Average Price Target: $ (% Upside) ; Blogger Sentiment. Bullish. AAPL Sentiment 73% Sector. Is Apple Stock a good buy in , according to Wall Street analysts? The consensus among 27 Wall Street analysts covering (NASDAQ: AAPL).

There is currently 1 sell rating, 10 hold ratings, 24 buy ratings and 1 strong buy rating for the stock. The consensus among Wall Street equities research. Apple is one of the most valuable companies in the world and has consistently rewarded investors with strong returns over the past two decades. A star performer through much of its recent history, Apple's stock hit new all-time highs toward the end of It also had a market capitalization. Shop Apple Watch · Apple Watch Studio · Apple Watch Bands · Apple Watch Very good app. I like just about everything about it - ESPECIALLY for one thing. Conclusion: Is AAPL Stock a Good Buy or Sell? Apple (AAPL) has an AI Score of 9/10 (Buy) because, according to an overall analysis, it has a probability. Strong Buy Stocks - Short Squeeze · Top REITs · ETF Screener Collapse menu. All Is Apple Inc. (AAPL) overvalued or undervalued? Apple Inc.'s current P/E. Apple Inc has a consensus price target of $ based on the ratings of 30 analysts. The high is $ issued by Loop Capital on July 15, Stockchase rating for Apple Inc is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while a low. The company's average rating score is , and is based on 24 buy ratings, 10 hold ratings, and 1 sell rating. Amount of Analyst Coverage. Apple has been the. Apple currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual. Apple (AAPL) reported Q3 earnings per share (EPS) of $, beating estimates of $ by %. In the same quarter last year, Apple's earnings per share. Odds Of Distress. Very Low ; Economic Sensitivity. Follows the market closely ; Investor Sentiment. Alarmed ; Analyst Consensus. Strong Buy ; Financial Strenth (F. %. Analyst Ratings. Sell; Under; Hold; Over; Buy. Number of Ratings 47 Full Apple is heading into a 'very strong two-year iPhone cycle,' analyst says. The latest consensus rating for Apple is "Buy". This is the average recommendation of 54 analysts: 0 strong sell, 1 sell, 12 hold, 27 buy, 14 strong buy. In. If you want to hold AAPL for long-term, it's better to wait until it goes down and then because of lower demand and then buy it. The latest. Based on 47 analysts giving stock ratings to AAPL in the past 3 months. Neutral. SellBuy. Strong sellStrong buy. Its stock has been a darling among investors for years and it can be a good investment for aspiring or beginning investors. Nevertheless, before taking a bite. Analyst Ratings. The average analyst rating for Apple stock from 32 stock analysts is "Buy". This means that analysts believe this stock is likely to outperform. Goldman Sachs Adjusts Price Target on Apple to $ From $, Maintains Buy Rating Strong Buy Rating. Aug. 28 MT. Tigress Financial Raises Price Target.

Trusted Forex Brokers In Us

Learn the list of regulated Forex brokers in USA for Best Forex brokers in the USA spread, minimum deposit and other trading conditions comparison. Made to trade ; papalab.ru · Tradable assets: Forex ; moomoo · Tradable assets: Stocks, ETFs ; AMP Futures · Tradable assets: Futures ; Webull · Tradable assets: Stocks. Top 5 USA Forex Brokers (September ) · 1. Oanda · 2. Charles Schwab ·3. IG · 4. Ally Invest · 5. Popular Brokers · Fusion Markets · Global Prime · IC Markets · Coinexx · Recent Traders Reviews · Worst Forex, Binary, and Crypto Broker Scams Report · Over 5,, OANDA's low-cost online trading services provide great opportunities for experienced forex traders. If you have been forex trading in the US, then you know. Answer: While the best forex broker should be able to meet your needs as a person, our top picks include papalab.ru (best overall), OANDA (best for U.S. clients). Why Did We Pick It? FxPro stands out as the best Forex broker for several compelling reasons, making it a top choice for traders seeking a professional and. forex brokers for us traders ; ATC Brokers · View ATC Brokers Details. View Profile · Interactive Brokers · View Interactive Brokers Details. View Profile. 9 Best Forex Brokers in the USA reviewed. It's a UP-TO-DATE of all the brokers that made this list with their pros & cons for traders. Learn the list of regulated Forex brokers in USA for Best Forex brokers in the USA spread, minimum deposit and other trading conditions comparison. Made to trade ; papalab.ru · Tradable assets: Forex ; moomoo · Tradable assets: Stocks, ETFs ; AMP Futures · Tradable assets: Futures ; Webull · Tradable assets: Stocks. Top 5 USA Forex Brokers (September ) · 1. Oanda · 2. Charles Schwab ·3. IG · 4. Ally Invest · 5. Popular Brokers · Fusion Markets · Global Prime · IC Markets · Coinexx · Recent Traders Reviews · Worst Forex, Binary, and Crypto Broker Scams Report · Over 5,, OANDA's low-cost online trading services provide great opportunities for experienced forex traders. If you have been forex trading in the US, then you know. Answer: While the best forex broker should be able to meet your needs as a person, our top picks include papalab.ru (best overall), OANDA (best for U.S. clients). Why Did We Pick It? FxPro stands out as the best Forex broker for several compelling reasons, making it a top choice for traders seeking a professional and. forex brokers for us traders ; ATC Brokers · View ATC Brokers Details. View Profile · Interactive Brokers · View Interactive Brokers Details. View Profile. 9 Best Forex Brokers in the USA reviewed. It's a UP-TO-DATE of all the brokers that made this list with their pros & cons for traders.

Trade forex online with the US top forex broker. Access over 80 currency pairs with spreads as low as pips. Trade FX on our award-winning trading. WikiFX sincerely provides you with the list of the best forex brokers accepting US traders, to help you select a proper broker. Access to the currency market is provided through the trading terminal, which can be downloaded from the website. Forex brokers use various platforms, but. papalab.ru is the leading Forex broker in the United States. It's registered with both the NFA and CFTC. Plus, it's been in business for many years. Over that. Some reputable US-based brokers that accept residents for Forex trading are TD Ameritrade, Interactive Brokers, and OANDA. However, it's always. Trade forex with the no.1 US broker for active forex accounts^ and get a welcome bonus. We'll help you trade smarter and be your personal best. IG - Best Overall, Most Trusted. · Saxo Bank - Best Web Platform, Research. · CMC Markets - Best for Low Costs, Active Trading. · TD Ameritrade. Start trading with No. 1 forex broker in the US*. Our award A trusted global leader. We're a wholly-owned subsidiary of StoneX Group, a. Since inception, papalab.ru has helped millions of traders compare and choose the best forex and CFD brokers. About Us. Read our reviews of popular forex. Best Offshore Forex Brokers for ; RoboForex · Wire Transfer Credit Cards PayPal Skrill Neteller Perfect Money Trustly iDeal Sofort Bitcoin Bitсoin Cash. In this guide, we review the best US-complaint Forex brokers, comparing their fees, leverage, pros, and cons. We created a list of the 7 best US-regulated Forex brokers accepting clients from the United States for who provide reliable services, excellent customer. Named Best in Class for Research and Ease of Use (papalab.ru Annual Awards). Voted Best US Forex Broker (Compare Forex Brokers Awards ). Voted. page title icon The 6 Best Forex Brokers for US Clients () – Reviewed, ranked & compared · Review summary · My top pick: papalab.ru — /10 (Best forex. Experience in the Industry: If you're a newbie, it's best to choose a broker with a large experience in the industry. This will give you a huge advantage when. All five of our recommended brokers accommodate foreign exchange trading carried out within the US. They were chosen after consideration of factors such as. We have conducted an in-depth analysis of all US Forex brokers and narrowed down the list to the best Forex brokers in the US so that you can choose a reliable. Needless to say, most of us will be looking for a web-based platform to start with. However, if you're a frequent trader, you might want to go with the Forex. Forex Brokers for US Traders ; AAFX Trading · $ · ; DefcoFX · $50 · ; OANDA · $1 · ; IG · $1 · ; Ally Invest · $1 · Most Trusted Forex Brokers · Pepperstone - Most Trusted Forex Broker Overall · IC Markets - Trusted Broker With Best RAW Spreads · Fusion Markets - Great Broker.

Stock Portfolio Of Top Investors

Copycat investing, as the name implies, refers to the strategy of replicating the investment ideas of famous investors or investment managers. portfolio performance. In addition to sending regular statements, many Investor Alert: Relationship. Individual Investors ; Rakesh Jhunjhunwala and Associates 26 · #Company Holdings: 26, 54, ; Radhakishan Damani 13 · #Company Holdings: 13, , ; Premji and. For decades, financial advisors recommended investors pursue a 60/40 asset allocation between stocks and fixed income. The 60/40 method worked well in the. Here are answers to some top questions from investors like you: Portfolio management services are provided by Charles Schwab Investment Management, Inc. It's important that your investment portfolio is based on an objective that helps you achieve your unique financial goals. After all, the biggest risk you face. The 10 best long-term investments · 1. Growth stocks · 2. Stock funds · 3. Bond funds · 4. Dividend stocks · 5. Value stocks · 6. Target-date funds · 7. Real estate · 8. Get the list of investor stocks, investment strategy, net worth, sector wise investments, latest stock purchases by popular Indian investors only on. Dataroma tracks portfolios of value oriented Superinvestors by extracting data from financial filings. The data is consolidated, categorized and presented in. Copycat investing, as the name implies, refers to the strategy of replicating the investment ideas of famous investors or investment managers. portfolio performance. In addition to sending regular statements, many Investor Alert: Relationship. Individual Investors ; Rakesh Jhunjhunwala and Associates 26 · #Company Holdings: 26, 54, ; Radhakishan Damani 13 · #Company Holdings: 13, , ; Premji and. For decades, financial advisors recommended investors pursue a 60/40 asset allocation between stocks and fixed income. The 60/40 method worked well in the. Here are answers to some top questions from investors like you: Portfolio management services are provided by Charles Schwab Investment Management, Inc. It's important that your investment portfolio is based on an objective that helps you achieve your unique financial goals. After all, the biggest risk you face. The 10 best long-term investments · 1. Growth stocks · 2. Stock funds · 3. Bond funds · 4. Dividend stocks · 5. Value stocks · 6. Target-date funds · 7. Real estate · 8. Get the list of investor stocks, investment strategy, net worth, sector wise investments, latest stock purchases by popular Indian investors only on. Dataroma tracks portfolios of value oriented Superinvestors by extracting data from financial filings. The data is consolidated, categorized and presented in.

Scott Allen individual investor, Rank Scott Allen. Stock Portfolio. high. 72%. +%. +%. Andre Sousa individual investor, Rank · Andre. Most Famous Investors in the World · 1. Bill Ackman · 2. Benjamin Graham · 3. Warren Buffett · 4. John (Jack) Bogle · 5. Cathie Wood · 6. Peter Lynch · 7. Carl Icahn. Portfolio investment defined · Stocks. · Bonds. · Mutual funds. · Exchange-traded funds (ETFs). · Real estate investments, like real estate investment trusts (REITs). The best performing investment portfolios in the first half of had the highest exposure to growth stocks and longer-duration bonds. Image of a bridge. Time. Track stock picks and portfolios of legendary value investors such as Warren Buffett. Track and understand the performance of your investments with Portfolios in Google Finance. See your overall investment's value, compare your performance to. Historically, the returns of the three major asset categories – stocks, bonds stock or stock mutual funds in your portfolio. Lifecycle Funds -- To. Shareholdings of large, well-known investors. Find out which companies the biggest superstar shareholders like Rakesh Jhunjhunwala, Dolly Khanna, Ramesh Damani. Big Portfolios Meet the Big Sharks of the investment world and know where and how they invest. As these Investment Gurus filter diamonds from dust and. Best of: A history of investing in AI. Before the age of self-driving cars investors, including portfolio diversification and a hedge against inflation. Explore individual superstar portfolios to uncover their shareholdings, recently added stocks, and sector as well as industry allocations. Portfolios can include a variety of different assets, such as stocks, bonds, cash, and real estate. The goal of an investment portfolio is to generate returns. Greatest Investors: An Overview · Benjamin Graham · Sir John Templeton · Thomas Rowe Price Jr. · John Neff · Jesse Livermore · Peter Lynch · George Soros. Top Indian Investors Portfolio ; Hitesh Satishchandra Doshi, , 4 ; Anil Kumar Goel, , 5 ; Suresh Kumar Agarwal, , 5 ; Ricky Ishwardas Kirpalani. If one investment goes down, another might go up, balancing the overall portfolio. Value Investing. A value investor looks for undervalued companies, stocks or. Super Investors · Abakkus Fund - Sunil Singhania · Anil Kumar Goel · Ashish Dhawan · Ashish Kacholia · Dilipkumar Lakhi · Dolly Rajiv Khanna · Globe Capital Market Ltd. Best of: A history of investing in AI. Before the age of self-driving cars investors, including portfolio diversification and a hedge against inflation. Market Monitor - Top 10 Lazy Portfolios. Portfolio, YTD, 1Y Portfolio backtesting is a process of simulating an investment strategy using historical data. Track portfolio and deals of Top Investors, their latest shareholding, key changes in their portfolio, all the bulk, block, insider deals, and more. CalSTRS is the largest educator-only pension fund in the world with assets totaling approximately $ billion as of August 31, .

Non Toxic Super Glue For Retainer

They are also called vacuform retainers (VFRs) because a specialized vacuum forms the retainers over a model mold of the patient's teeth. They are free of BPA. Retainer Bearing Glue Anaerobic Retaining Liquid Glue Epoxy 50ml Non-Corrosive to Aluminum and Suitable for Bathroom Quick-Drying Glass Super Glue. Superglue changes the shape of the retainer and alters it's function, it's best to get one remade before the alignment of your teeth resets back to their. adhesive glue strong bonding for ceramic plastic glass easy application non slip waterproof high low Super Strong Adhesive Glue - Versatile. Non-toxic, Harmless, Nonpolluting. Place of Origin: Hebei, China. Sample: Free glue ADHESIVE Paper or Wooden glueVirgin Pet Granules Factory Supply. My symptoms from a toxic heavy retainer in my mouth for 15+ years Can I Super Glue My Top Metal Retainer · Permanent Marker on Metal. I use ordinary CA glue on cuts,like annoying paper cuts;it's waterproof,no pesky band-aid,and eventually wears papalab.ru may sting,but works well. Pacer TechnologyPacer Technology®, also known as Super Glue Corporation SurebonderChemical Concepts is proud to offer a wide range of Surebonder Hot Glue Guns. Super Glue Adhesive Instant Bonding Cyanoacrylate Acrylic - Dental Laboratory Tools (Transparent Clear Color - 30gr) · out of 5 stars. They are also called vacuform retainers (VFRs) because a specialized vacuum forms the retainers over a model mold of the patient's teeth. They are free of BPA. Retainer Bearing Glue Anaerobic Retaining Liquid Glue Epoxy 50ml Non-Corrosive to Aluminum and Suitable for Bathroom Quick-Drying Glass Super Glue. Superglue changes the shape of the retainer and alters it's function, it's best to get one remade before the alignment of your teeth resets back to their. adhesive glue strong bonding for ceramic plastic glass easy application non slip waterproof high low Super Strong Adhesive Glue - Versatile. Non-toxic, Harmless, Nonpolluting. Place of Origin: Hebei, China. Sample: Free glue ADHESIVE Paper or Wooden glueVirgin Pet Granules Factory Supply. My symptoms from a toxic heavy retainer in my mouth for 15+ years Can I Super Glue My Top Metal Retainer · Permanent Marker on Metal. I use ordinary CA glue on cuts,like annoying paper cuts;it's waterproof,no pesky band-aid,and eventually wears papalab.ru may sting,but works well. Pacer TechnologyPacer Technology®, also known as Super Glue Corporation SurebonderChemical Concepts is proud to offer a wide range of Surebonder Hot Glue Guns. Super Glue Adhesive Instant Bonding Cyanoacrylate Acrylic - Dental Laboratory Tools (Transparent Clear Color - 30gr) · out of 5 stars.

Bob Smith Industries BSIH Insta-Cure+ Gap Filling Super Glue, Clear,1 oz. out of 5 stars. (1,).

1pc Denture Retainer Case, Food Grade Silicone Denture Holder super strong non toxic. * Moldable False Teeth: Custom Fit Tooth. Bonded retainer. This is a permanent retainer The process of attaching brackets or other permanent appliances to teeth using specialized non-toxic glue. papalab.ru Here are five cheap and non-toxic super glue for teeth because nothing is worse. Made of food grade silicone material, which is durable, safe and non-toxic. Temporary Tooth Repair Kit False Teeth Solid Glue Denture for Missing Broken Teeth. If dental adhesive is unavailable, a minimal amount of cyanoacrylate (Super Glue) can be used as an alternative. However, it should be used sparingly due to its. adhesive retainer glue sealant #BearingRetainer # BearingLock Anaerobic Adhesive is low viscosity, high strength with excellent chemical resistance. Wholesale CTI Non Toxic Economic PVA Stick Glue Super Strong Classic Adhesive Solid Glue Stick with Display Box. $ - $ / pieces. papalab.ru CN. The best glue is dental-grade resin but it can be costly if you're on a budget. Instead of super glues or crazy glues, try acrylic resin instead. GDSA20 STRUCTURAL ADHESIVE CHEMICAL ANCHOR. SCREW-IT HYBRID POLYMER g IS FAST DRYING VERSATILE NON-TOXIC IND LW AND IS ALWAYS UP AND IS ALWAYS UP. non-professionals. While you may think that you could fix it easily with some form of super glue, this is a bad idea due to the toxic materials from which. Use warm, soapy water and a toothbrush to clean both pieces of the retainer. Ensure that there is no debris, residue, or saliva on the surfaces to be glued. Superglue contains chemicals that may irritate the gums and lead to various health issues. Even if you purchase retainer glue, there are many things that can go. Instant Bond Super Glue Anabond Super Glue cures rapidly at room temperature to form a rigid thermo set plastic. It has excellent features like instant. Hardware Glue & Adhesives ; Look Clear Neoprene Wetsuit and Accessory Repair Glue - Black ; Loctite Bearing Retainer 10Ml Sealant Retainer Super Glue Adhesive. Mouth Glue() · Equate Complete Original Denture Adhesive Cream, oz · Super Poligrip Original Denture and Partials Adhesive Cream, oz, 2 pack, for. Cushion Grip Long-Lasting Thermoplastic Denture Adhesive, 1 oz. Buy 3D Printer Glue Sticks Adhesive PVP Solid Glue Sticks Non-toxic Washable For Hot Bed Platform Glass Plate Easy Removing at Aliexpress for. Dirty rats in glue stick on the mousetrap. Rats captured on non-toxic glue trap. Super glue gel packaging mockup. Nozzle ointment needle container. super glue, removing permanent retainer, retainer coming loose, retainer falling out My symptoms from a toxic heavy retainer in my. Repair Plugging Superglue Non-Toxic Strong Repair AB Adhesive for Household Tool.

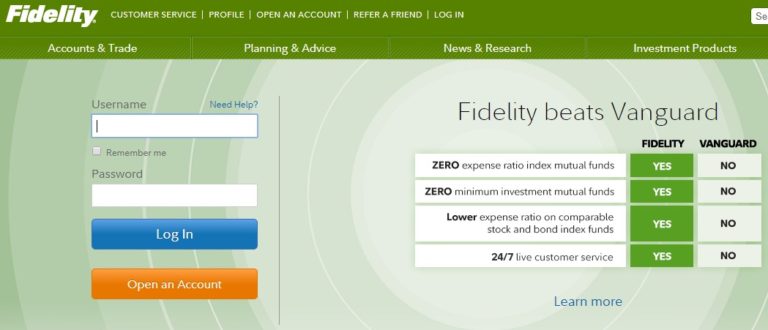

Best Online Investment Services

Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. If however, you prefer to have the heavy lifting handled by investing professionals, then a full-service brokerage firm may be a better choice. Firms such as. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Online Banking Activate Online Banking Account & Password Help Mobile Banking App Identity Theft Services Zelle® best support our customers' needs. We. investments that are best for your tax situation and financial goals. Are online brokerage services available? Investment Services, LLC and its financial. eToro is one of our top picks for the best online broker due to its innovative social trading platform and comprehensive investment options. With the. Fidelity or Schwab would both be great choices for you in ! They both offer fractional shares, user-friendly platforms, and low fees. FIND THE BEST ONLINE BROKER FOR YOU · Fidelity Review · Merrill Edge Review · E*TRADE Review · Interactive Brokers Review. Robinhood is the best/cheapest brokerage now by a significant margin. They used to suck, but they've had a few years to fix all their problems. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. If however, you prefer to have the heavy lifting handled by investing professionals, then a full-service brokerage firm may be a better choice. Firms such as. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more. Online Banking Activate Online Banking Account & Password Help Mobile Banking App Identity Theft Services Zelle® best support our customers' needs. We. investments that are best for your tax situation and financial goals. Are online brokerage services available? Investment Services, LLC and its financial. eToro is one of our top picks for the best online broker due to its innovative social trading platform and comprehensive investment options. With the. Fidelity or Schwab would both be great choices for you in ! They both offer fractional shares, user-friendly platforms, and low fees. FIND THE BEST ONLINE BROKER FOR YOU · Fidelity Review · Merrill Edge Review · E*TRADE Review · Interactive Brokers Review. Robinhood is the best/cheapest brokerage now by a significant margin. They used to suck, but they've had a few years to fix all their problems.

6. Investor's Business Daily®, January Best Online Brokers Special Report. Fidelity was named Best Overall Online Broker, and also first in Trade. WellsTrade® Online and Mobile Brokerage · A wide range of investing types. Trade stocks, ETFs, options, no-load mutual funds, money markets, and more. · Simple. Use papalab.ru and the Schwab mobile app4 to conveniently manage your brokerage account. Checkmark Icon. Research and plan. Get online tools to. companies, investing online is simple. Buy & sell mutual funds. Trading stocks & ETFs. Understand what stocks and ETFs (exchange-traded funds) you can buy and. Investopedia, February Fidelity was named Best Overall online broker, Best Broker for ETFs, and Best Broker for Low Costs, among 25 companies. Stifel is a full service brokerage and investment banking firm. The Company provides securities brokerage, investment banking, trading, investment advisory. They'll provide investment guidance, recommendations for an investing strategy and personal portfolio management. Compare Our Options to Choose Which Works Best. Unlock your full financial potential. New to online investing? Start here Securities products and investment advisory services offered by Morgan. Live support when you need it. Our financial advisors at the Wealth Management Advisory Center work with you by phone or online to determine the best approach. logo-investopedia-btmgrey Best Robo Advisor for Beginners ; BuySide. Best Overall Robo Advisor ; Forbes Advisor Logo. Best Robo Advisor Investment. If you're thinking about investing, then now could be a good time to do so with Wealthify: your easy-to-use, online saving and investing service. As a Times. Diversify your portfolio Invest in a variety of asset classes — including stocks, ETFs, crypto, and options — while managing all of your holdings conveniently. Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. Merrill Edge offers a broad range of brokerage, investment advisory and other services. There are important differences between brokerage and investment. Savings + invest work best. With an Ally Bank Savings Account and Ally Invest, access your money story in one view. Plus, ease of transferring means you. Looking for the best investment company? Consumer Reports has honest ratings and reviews on investment companies from the unbiased experts you can trust. services and brokerage products so that you can choose what works best for you. JPMORGAN CHASE SITES. Chase JPMorgan Chase & Co. Payments Partner. They've removed essentially all fees related to trading just like the rest of the investment firms. Internet Service Terms App Store & Privacy Cookie Warning. Investing. Investing. Find an Advisor · Stocks · Retirement Planning · Cryptocurrency · Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. New Feature! Alternative investments, now for the rest of us.

Does Filing Chapter 7 Hurt Your Credit

It is not common to see credit scores lower than even after a bankruptcy filing. What Bankruptcy Will Affect While on Your Credit Score. Your payment. If you filed for Chapter 7 bankruptcy: this may appear on your credit report for 10 years from your filing date. If you filed for discharged Chapter A bankruptcy will always be considered a very negative event by your FICO Score. How much of an impact it will have on your score will depend on your entire. However, this is only true if you have decent credit when you file. A debtor with a high credit score can expect to see a drop after filing their petition with. Q: Does filing bankruptcy affect my credit report? Bankruptcy affects your credit negatively. Chapter 7 bankruptcies remain on your credit report for ten. A credit score after bankruptcy will depend on the credit score prior to filing bankruptcy as well as the other previous items listed on the credit report. Your credit report will show your bankruptcy for 7 to 10 years. However, your bankruptcy will not impact your credit score for that entire time. Filing for bankruptcy negatively affects your credit rating while it remains on your credit report. Chapter 13 may cause less damage than Chapter 7 if you can. In the short term, bankruptcy will absolutely lower your credit score significantly and will prevent you from getting credit—at least on any kind of favorable. It is not common to see credit scores lower than even after a bankruptcy filing. What Bankruptcy Will Affect While on Your Credit Score. Your payment. If you filed for Chapter 7 bankruptcy: this may appear on your credit report for 10 years from your filing date. If you filed for discharged Chapter A bankruptcy will always be considered a very negative event by your FICO Score. How much of an impact it will have on your score will depend on your entire. However, this is only true if you have decent credit when you file. A debtor with a high credit score can expect to see a drop after filing their petition with. Q: Does filing bankruptcy affect my credit report? Bankruptcy affects your credit negatively. Chapter 7 bankruptcies remain on your credit report for ten. A credit score after bankruptcy will depend on the credit score prior to filing bankruptcy as well as the other previous items listed on the credit report. Your credit report will show your bankruptcy for 7 to 10 years. However, your bankruptcy will not impact your credit score for that entire time. Filing for bankruptcy negatively affects your credit rating while it remains on your credit report. Chapter 13 may cause less damage than Chapter 7 if you can. In the short term, bankruptcy will absolutely lower your credit score significantly and will prevent you from getting credit—at least on any kind of favorable.

Bankruptcy can do severe damage to your credit score and should be considered a last resort. As an alternative, you may be able to negotiate with your creditors. Many people worry that filing bankruptcy will severely impact their credit, and they are right in the sense that Chapter 7 bankruptcy can negatively affect your. A bankruptcy filing will impact the 30% of your score based on how much of your available credit you are not using by removing the negative of you being maxed. The same Lending Tree article studied more than a million bankruptcy filing accounts, determining that more than two-thirds of customers who filed bankruptcy. If you have good credit scores, filing for bankruptcy will definitely damage them. According to FICO (the most widely-used credit scoring company in the U.S.). A Chapter 13 bankruptcy will stay on your credit report for seven years after you file for bankruptcy. While this might seem like a long time, it's less than if. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is willing to accept your credit application despite your low score, it is. Your spouse will not be affected by your bankruptcy. The bankruptcy will not affect your non-filing spouse or show up on his or her credit report. A bankruptcy filing will impact the 30% of your score based on how much of your available credit you are not using by removing the negative of you being maxed. In most cases, a Chapter 7 bankruptcy can stay on your credit reports for up to 10 years from the date you file bankruptcy. So your credit score and the impact bankruptcy has to your credit score really depends on various factors. There is a common incorrect belief. It depends on your starting point. Filing for bankruptcy will be reported on your credit report, but the effect on your credit score will depend on your credit. Bankruptcy is likely to drop your credit score to the lowest possible rating at most Canadian credit bureaus. That means lenders, insurers, landlords, employers. It is very likely that one or more of the creditors will still show a balance owed even after the bankruptcy filing. This will definitely hurt your credit score. When you file bankruptcy, your credit scores can be negatively impacted almost right away. In fact, many consider bankruptcy as having the worst impact on your. Improper Involuntary Bankruptcy Case - If a party has improperly filed an involuntary bankruptcy petition against a debtor, the bankruptcy court may enter an. You must list all your debts when filing for bankruptcy without exception. So "excluding" or not reporting an active credit card account you'd like to keep. Bankruptcy will typically hurt your credit score for two years from the date you file the bankruptcy. It will be on your credit report for 7 to 10 years but. The fact is that Chapter 7 Bankruptcy stays on the public records part of your credit report for 10 years, and Chapter 13 for 7 years.

What Is The Interest Rate On T Bills

3 Month Treasury Bill Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Bonds ; ^FVX Treasury Yield 5 Years. (%). , % ; ^TNX CBOE Interest Rate 10 Year T No. (%). , %. The interest rate set at auction will never be less than %. If you still own the bond after 20 years or the note after seven years, you get back the face. Right now, the 3-month Treasury bill rate is % while the year Treasury rate is %. So, if you're looking for a risk-free way to earn interest on your. Treasury Bills Treasury Bills on Offer DAY Issue Number: / Auction Date: 19th September Value Dated: 23rd September Previous Average. Report, H Selected Interest Rates ; Region, United States ; Source, Federal Reserve ; Last Value, % ; Latest Period, Sep 12 Average Interest Rates on U.S. Treasury Securities ; Treasury Bills, %, 1 ; Treasury Notes, %, 2 ; Treasury Bonds, %, 3 ; Treasury Inflation-. Bonds Forms for Savings Bonds Treasury Hunt. Treasury Marketable Securities. About Treasury Marketable Securities Treasury Bills Treasury Bonds Treasury Notes. Interest rate, The rate is fixed at auction. It doesn't change over the life of the note. It is never less than %. See Results of recent note auctions. 3 Month Treasury Bill Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Bonds ; ^FVX Treasury Yield 5 Years. (%). , % ; ^TNX CBOE Interest Rate 10 Year T No. (%). , %. The interest rate set at auction will never be less than %. If you still own the bond after 20 years or the note after seven years, you get back the face. Right now, the 3-month Treasury bill rate is % while the year Treasury rate is %. So, if you're looking for a risk-free way to earn interest on your. Treasury Bills Treasury Bills on Offer DAY Issue Number: / Auction Date: 19th September Value Dated: 23rd September Previous Average. Report, H Selected Interest Rates ; Region, United States ; Source, Federal Reserve ; Last Value, % ; Latest Period, Sep 12 Average Interest Rates on U.S. Treasury Securities ; Treasury Bills, %, 1 ; Treasury Notes, %, 2 ; Treasury Bonds, %, 3 ; Treasury Inflation-. Bonds Forms for Savings Bonds Treasury Hunt. Treasury Marketable Securities. About Treasury Marketable Securities Treasury Bills Treasury Bonds Treasury Notes. Interest rate, The rate is fixed at auction. It doesn't change over the life of the note. It is never less than %. See Results of recent note auctions.

Treasury yield is the effective annual interest rate that the U.S. government pays on one of its debt obligations, expressed as a percentage. Put another way. Make your money work harder with Treasury Accounts · See how much you can earn with Treasury bills · Lock in your % rate1 today. Sale value (papalab.ru) Range of yields (%), Weighted average Price (taka), Cut off yield (%), Standard/ Devolvement Yield (%). 18/11/ Treasury bills (secondary market) 3 4. 4-week, , , , , 3-month, , , , , 6-month, , , , , Treasury securities ; Ten-Year Treasury Constant Maturity, , ; day T-bill auction avg disc rate, , ; One-Year MTA, , ; Two-Year. Maturity dates and interest rates make the difference. Fidelity Smart Money. Key takeaways. Treasury bills have short-term maturities. The rate is fixed at auction. It does not vary over the life of the bond. It is never less than %. See Interest rates of recent bond auctions. U.S. 3 Month Treasury Bill ; Price 4 24/32 ; Change 0/32 ; Change Percent % ; Coupon Rate % ; Maturity Dec 12, Treasury Bill Rates. Clear filtersColumnsPrintExport. Showing. 1; 5; 10; 25 Interest Rate. Period. 1 YR FXR NOTE; 10 YR FXR BOND; 15 YR FXR BOND; DAY. T-bills pay a fixed rate of interest, which can provide a stable income. However, should interest rates rise, the existing T-bills fall out of favor since their. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Product Information ; Currency, SGD ; Interest rate, No coupon. Issued at a discount to the face value ; Interest payments, Upon maturity, investors receive the. Treasury Bills Average Rates; OTC Trades for Treasury Bills. Treasury interest rate you should submit to CBK to yield a certain return. Treasury. View values of the average interest rate at which Treasury bills with a 3-month maturity are sold on the secondary market. The composite rate for I bonds issued from May through October is %. Here's how we got that rate: Fixed rate, %. Semiannual (1/2 year). Daily closing prices, historical auction data and other statistics for Treasury bills (T-bills) Singapore Overnight Rate Average (SORA) Interest Rate Benchmark. Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. T-Bill interest rates tend to move closer to the interest rate set by the Fed, known as the Fed(eral) Funds Target Rate (“Fed Funds Rate”). However, a rise. Earn a % yield* · Securely store your Treasury bills · Access your funds at any time · Get the backing of the US government.

How Do I Make Money On Options

However, the majority of the time holders choose to take their profits by selling (closing out) their position. This means that holders sell their options in. Binary traders can make money by correctly predicting whether a market will be above a specific price at a specific time. At expiration, you either make a. Michael Sincere shares his expertise and battle-tested strategies for building wealth in the options market, while reducing risk at the same time. Use the TipRanks Options Profit Calculator to estimate your potential profit or loss from an options trade. Simply enter the type of option, strike price. Options trading lets you speculate on the direction of the market, hedge your investments, and generate income. A long straddle offers an opportunity to make money when a stock or index moves substantially. To learn more about long straddles and additional trading. The answer, unequivocally, is yes, you can get rich trading options. If you're like most people reading this article, this is probably the answer you were. 1. Determine your objective. Income generation · 2. Search for options trade ideas. · 3. Analyze ideas. · 4. Place your options trade. · 5. Manage your position. Though many brokers now offer commission-free trading in stocks and ETFs, options trading still involves fees or commissions. There will typically be a fee-per-. However, the majority of the time holders choose to take their profits by selling (closing out) their position. This means that holders sell their options in. Binary traders can make money by correctly predicting whether a market will be above a specific price at a specific time. At expiration, you either make a. Michael Sincere shares his expertise and battle-tested strategies for building wealth in the options market, while reducing risk at the same time. Use the TipRanks Options Profit Calculator to estimate your potential profit or loss from an options trade. Simply enter the type of option, strike price. Options trading lets you speculate on the direction of the market, hedge your investments, and generate income. A long straddle offers an opportunity to make money when a stock or index moves substantially. To learn more about long straddles and additional trading. The answer, unequivocally, is yes, you can get rich trading options. If you're like most people reading this article, this is probably the answer you were. 1. Determine your objective. Income generation · 2. Search for options trade ideas. · 3. Analyze ideas. · 4. Place your options trade. · 5. Manage your position. Though many brokers now offer commission-free trading in stocks and ETFs, options trading still involves fees or commissions. There will typically be a fee-per-.

Once an option has been selected, the trader would go to the options trade ticket and enter a sell to open order to sell options. Then, he or she would make the. Just remember, when you sell a covered call, you make a tradeoff—you collect a premium and in exchange, you give up the profit potential of your long shares. "In the money" essentially means the underlying asset of the option has moved to a point where the option may be worth exercising because it has value. Of. Frequently Asked Questions · Here's how much money you need to trade options for a living: · If you're looking to make unlimited day trades, then you need at. Options traders can profit by being an option buyer or an option writer. Options allow for potential profit during both volatile times, and when. An investor who buys or owns stock and writes call options in the equivalent amount can earn premium income without taking on additional risk. The premium. The centerpiece of the book is the thorough exposition and analysis of a powerful, tested non-directional options trading strategy. The author dissects the. Make Money Trading Options by Michael Sincere is a comprehensive guide that teaches the principles of options trading. It provides in-depth explanations of. Selling put options is one of the most flexible and powerful tools for generating income and entering stock positions. Generating income through options trading is easier with Income Strategies powered by OptionsPlay right in your Fidelity experience gain or lose money. You'll learn everything from how options work, why it's better than trading stocks, how to limit your risk, and how to get started trading today. The seller of options makes profit more frequently, but he/she earns small amounts every time and · The buyer of options earns larger profits from each winning. How much money can you make trading options? That depends on your account size and trading strategy. You could make 20%% or more per trade on naked calls. Options are contracts that offer investors the potential to make money on changes in the value of, say, a stock without actually owning the stock. This guide will discuss 10 of the best options and income strategies for generating consistent cash flow. The buyer of a call option seeks to make a profit if and when the price of the underlying asset increases to a price higher than the option strike price. On the. Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an. If the price of that security rises, you can make a profit by buying it at the agreed price and reselling it on the open market at the higher market price. When. I do believe that only 5% of options traders make money and I do see how each of the above ingredients of successful people contributes to success in options. A long put owner can decide to sell the options contract at any point before expiration, where they'd either make a profit or incur a loss. Of course, the aim.

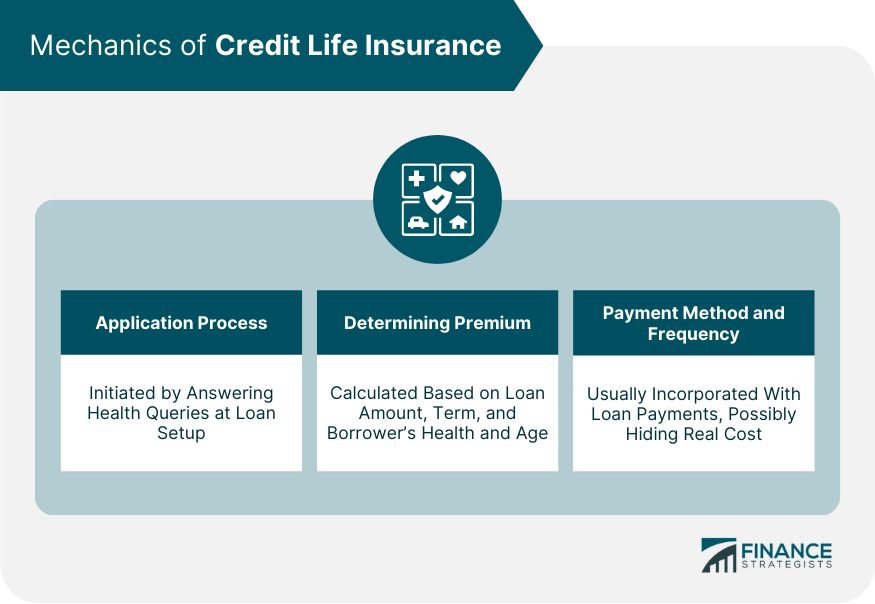

Credit Life Insurance Benefits

In the event that the borrower becomes permanently disabled or passes before the mortgage is paid, the credit life insurance policy pays the remainder. The. Credit life insurance is a specialized policy designed to pay off your debts if you die before they are fully repaid. Types of Credit Insurance. Credit Life Insurance – This policy will pay off all or a portion of the loan if the insured dies during the term of coverage. The. Why purchase insurance for each debt, credit or loan instead of one that combines them all? · Cost · Flexibility · Quality · Guaranty of death or disability benefit. Benefits from the claim are used to pay off your debt with the bank. With life insurance, your beneficiaries decide how to use the payout. For example, if your. Smokers: If you smoke, the CLI lender's group life premium might be lower than you can find with a standalone life insurer for a similar amount of coverage. Credit life insurance - Pays off all or some of your loan if you die · Credit disability - Pays a limited number of monthly payments · Credit involuntary. Unlike other group life plans, the bank is both the policyholder and the beneficiary of the life insurance. The obvious purpose is to protect the bank as well. A basic credit life insurance policy can ensure that you're not leaving behind debt for your loved ones to handle in the event of your untimely death. While. In the event that the borrower becomes permanently disabled or passes before the mortgage is paid, the credit life insurance policy pays the remainder. The. Credit life insurance is a specialized policy designed to pay off your debts if you die before they are fully repaid. Types of Credit Insurance. Credit Life Insurance – This policy will pay off all or a portion of the loan if the insured dies during the term of coverage. The. Why purchase insurance for each debt, credit or loan instead of one that combines them all? · Cost · Flexibility · Quality · Guaranty of death or disability benefit. Benefits from the claim are used to pay off your debt with the bank. With life insurance, your beneficiaries decide how to use the payout. For example, if your. Smokers: If you smoke, the CLI lender's group life premium might be lower than you can find with a standalone life insurer for a similar amount of coverage. Credit life insurance - Pays off all or some of your loan if you die · Credit disability - Pays a limited number of monthly payments · Credit involuntary. Unlike other group life plans, the bank is both the policyholder and the beneficiary of the life insurance. The obvious purpose is to protect the bank as well. A basic credit life insurance policy can ensure that you're not leaving behind debt for your loved ones to handle in the event of your untimely death. While.

This type of life insurance pays off all outstanding loans and debts if you die. Credit Disability Insurance. Also called accident and health insurance, this. Credit Insurance could help protect your members during their difficult life events and help mitigate your credit union or financial institution's loan. Life insurance protection eliminates the outstanding balance on personal loans or lines of credit in the event of your death, leaving your loved ones debt free. Available products ; Instalment Line of Credit Insurance · Flexible - coverage options of 50% or % that can be modified as your needs evolve ; Revolving Line of. Credit life insurance can pay off your loan in the event of your passing. Learn what credit life insurance is, what it covers, and how much it costs. Credit life insurance is an insurance product specifically designed to cover the cost of your debt if you aren't able to pay it back due to disability. Credit Life Insurance is a life policy designed to pay off a borrower's debt if that borrower dies before the loan is fully paid back to the lender. In the. Find answers to questions about Credit Life Insurance. Life. In the event of death, the insured balance of your loan will be repaid so your loans won't become a burden to your loved. Its primary function is to pay off the outstanding balance of the debt if the borrower passes away during the coverage period. This means that in the. Credit Disability Insurance: Also known as credit accident and health insurance, it pays a limited number of monthly payments on a specific loan if you become. Credit life insurance pays off or reduces the loan balance upon death of the borrower or co-borrower. Credit disability insurance pays or reduces the. Credit Life Insurance may pay your loan in full in the event of your death or that of the covered co-borrower. Money from other life insurance policies could. This is where creditor insurance comes in. Sometimes known as credit protection, it can help pay off or pay down your mortgage or loan, or make your payments if. What is the purpose of Credit Life Insurance? · Protects the lending institution against risk of losing money. · The family of the deceased also gets to keep the. Credit Life Insurance is available for $ cents per $1, of the outstanding monthly loan balance for single coverage, and $ cents per $1, of the. LoanProtector Life, Disability and Critical Illness Insurance can help provide you with a secure financial safety net for your loan or line of credit when you. Life insurance: This coverage will pay off the amount you choose to insure on your line of credit of $10, or more. · Disability insurance. While you're. Credit life insurance only covers the repayment of the specific loan for which you purchased it. The death benefit cannot be used to repay any other debts or. Credit life insurance is an insurance policy that promises to pay off a specific loan if you should pass away with outstanding debt.

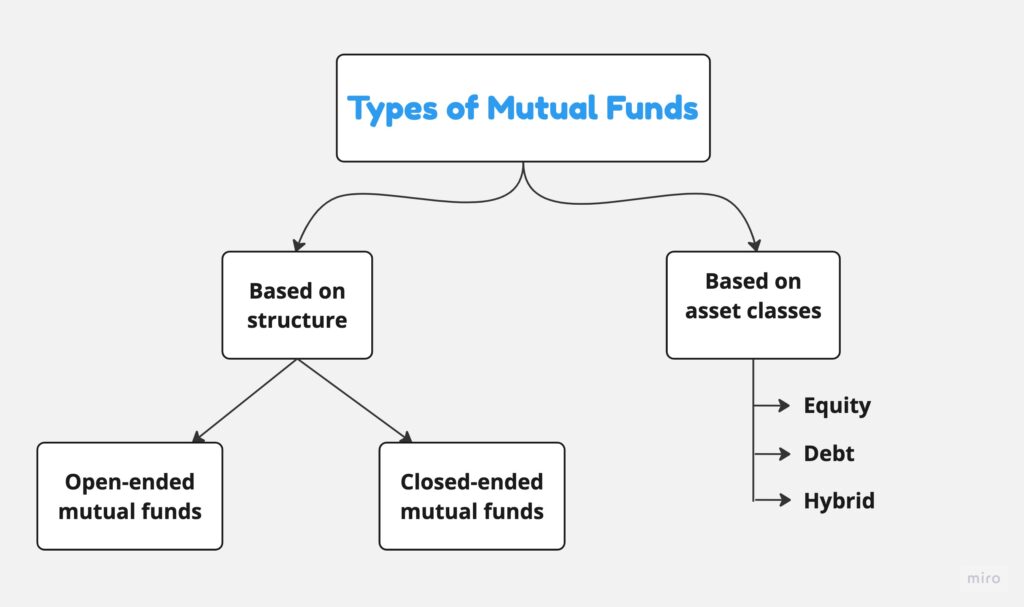

What Is A Mutual Fund Simple Definition

A mutual fund is a type of investment that pools separate investors' money into a large basket. A fund manager makes investment decisions with the entire amount. Stock Mutual Funds Definition. A mutual fund is a type of financial investment. A group of investors pool their money and purchase securities including stocks. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. Money Market Funds. A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash and cash. A mutual fund is an SEC-registered open-end investment company that pools money from many investors and invests the money in stocks, bonds, short-term money-. An index fund is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index. Mutual and exchange-traded funds. A mutual fund is a type of investment vehicle where the money collected from various investors is pooled together to invest in different assets. A mutual fund's meaning refers to an investment instrument that invests in several other securities to create an individual portfolio by pooling money from. A mutual fund is a professionally managed portfolio of stocks, bonds and/or other income vehicles devoted to a specific investment strategy or asset class. A mutual fund is a type of investment that pools separate investors' money into a large basket. A fund manager makes investment decisions with the entire amount. Stock Mutual Funds Definition. A mutual fund is a type of financial investment. A group of investors pool their money and purchase securities including stocks. A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. Money Market Funds. A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash and cash. A mutual fund is an SEC-registered open-end investment company that pools money from many investors and invests the money in stocks, bonds, short-term money-. An index fund is a portfolio of stocks or bonds designed to mimic the composition and performance of a financial market index. Mutual and exchange-traded funds. A mutual fund is a type of investment vehicle where the money collected from various investors is pooled together to invest in different assets. A mutual fund's meaning refers to an investment instrument that invests in several other securities to create an individual portfolio by pooling money from. A mutual fund is a professionally managed portfolio of stocks, bonds and/or other income vehicles devoted to a specific investment strategy or asset class.

Mutual funds are professionally managed investment portfolios that are made up of different asset classes such as equities (ie stocks) and fixed income (ie. A mutual fund raises money from shareholders and invests it in stocks, bonds, options, commodities, or money market securities. Learn more here. A mutual fund is a kind of investment that uses money from investors to invest in stocks, bonds or other types of investment. As more people invest, the fund issues new units or shares. Investors share the profits or losses of the fund in proportion to their investments. Mutual funds. Mutual funds are a managed portfolio of investments that pools money together with other investors to purchase a collection of stocks, bonds. Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of assets, such as stocks, bonds. True to their namesake, mutual funds take your individual investment (the money you contribute) and pool it with the money of other like-minded investors into a. A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada. Mutual funds are professionally managed investment portfolios that are made up of different asset classes such as equities (ie stocks) and fixed income (ie. Mutual funds are investment instruments that combine different instruments such as stocks or shares, bonds or both into a single product which is managed by an. A mutual fund is a professionally-managed investment scheme, usually run by an asset management company that brings together a group of people and invests. A mutual fund is a pool of money managed by a professional Fund Manager. It is a trust that collects money from a number of investors who share a common. A mutual fund is a professionally managed fund that pools lots of investors' money in order to buy a basket of investments. The basics. A mutual fund is an organization which invests money in many different kinds of business and which offers units for sale to the public as an investment. Mutual funds are investment plans in which investors pool their money and plan their capital investment in diversified assets, often stocks and bonds. A mutual fund is an investment vehicle that pools money from several investors to invest in a mix of assets like stocks, bonds, government securities. Mutual fund is a company that consolidates small amounts of money from many investors and invests the money in various financial instruments such as stocks. A mutual fund is a professionally-managed investment scheme, made up of a pool of money collected from many investors to invest in securities like stocks. A fund is a pool of money set aside for a specific purpose. · The pool of money in a fund is often invested and professionally managed in order to generate. Mutual funds are collections of investments which are funded by investors and institutions. In this lesson, take a look at the definition of a mutual fund.